Engage in Real Business Activity

Without Running One Yourself

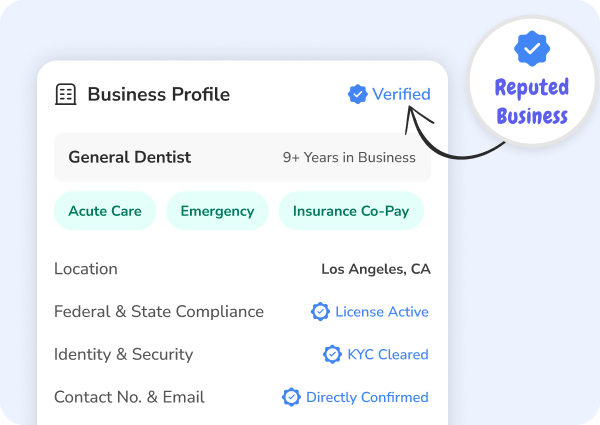

Vetted Contracts from

Reputed Businesses

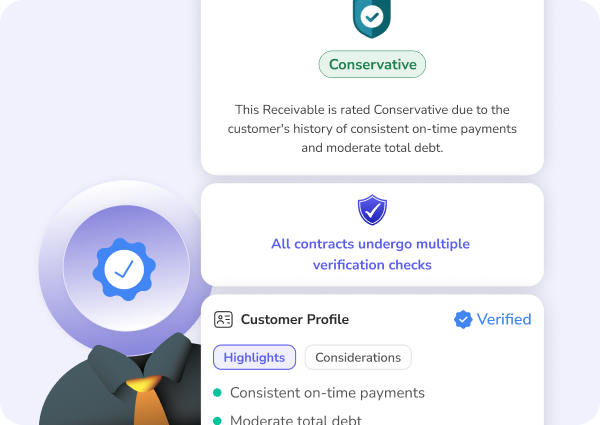

Every receivable listed on LendeeApp is vetted for credibility and consistency. You get a thorough review of the contract, including the risk assessments, and insights into both the customer and business profiles. You can also assess patterns based on indicators such as payment behavior and creditworthiness. This enables you to select contracts that align with your risk appetite and meet your financial goals.

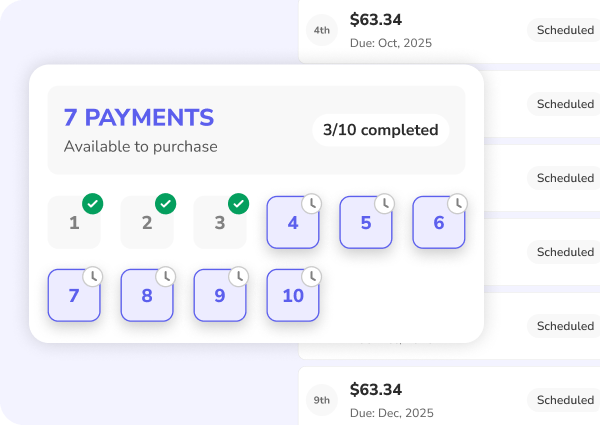

Take Over What’s Already Working

You acquire a part of an already active business contract for a short time frame and receive the scheduled repayments linked to that portion. Payments follow the contract’s predefined timeline, so you have clarity on frequency and duration from day one.

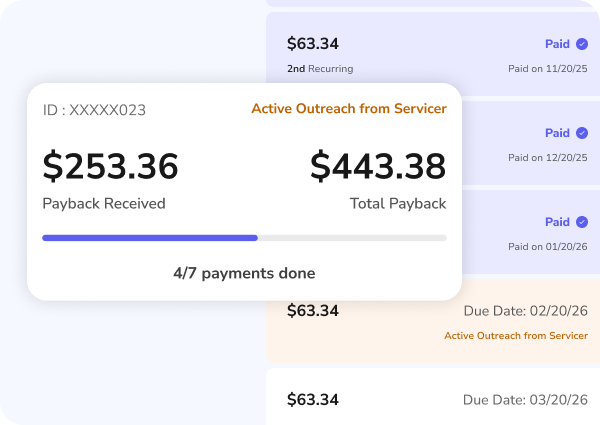

Collections & Servicing Support

Once you acquire a portion of a contract, the repayment process is fully managed on your behalf. If a payment is delayed or missed, our partnered servicers and collection agencies step in to handle follow-ups and recovery. No calls, no chasing, no coordination required from you — the entire process stays professionally managed.

Safe, Secure, & Trusted Platform

We thoroughly review both the business and the customer tied to each contract, assessing payment history, reliability, and overall risk. With caps on participation, automated tracking, and complete visibility into schedules and status, you remain informed, protected, and fully aware of how your contract is progressing at every step.

How It Works

Explore Available Contracts

Browse Contract Receivables on the LendeeApp and see opportunities that suit your preferences.

Evaluate & Choose

Review the risk profile and details of each contract to select the one that aligns with your goals.

Fund the Offer

Complete the payment, and the contract is assigned to you and tracked automatically within the platform.

Receive Payments

Each payment is transferred to your LendeeApp Wallet according to the contract’s timeline, with real-time visibility