Broadening Access to Financial Participation

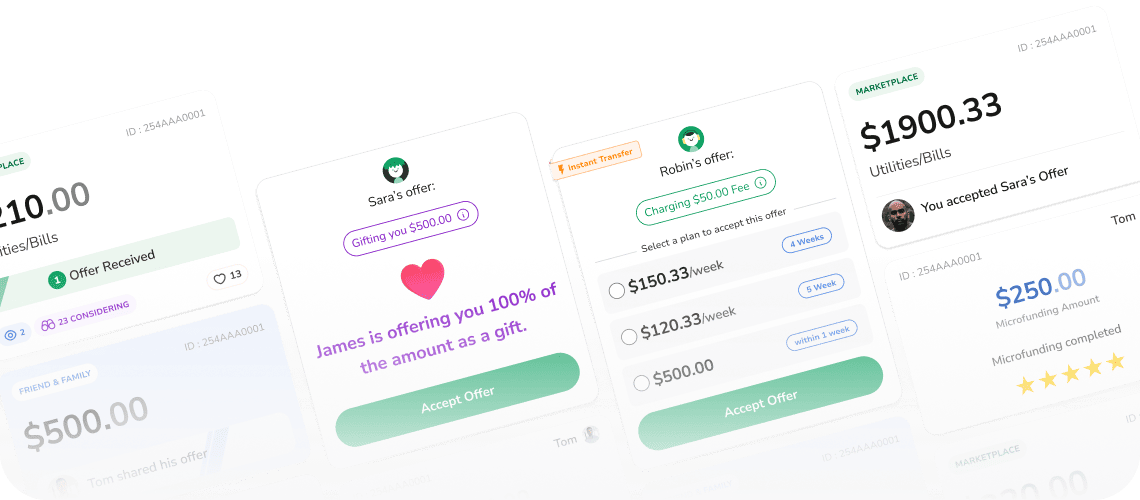

As LendeeApp has grown, our vision of financial inclusion has expanded beyond a single use case. We believe inclusion means giving people more than one way to take part in real financial activity.

Alongside Microfunding, Contract Receivables represent another way LendeeApp opens access to parts of the financial system that have traditionally been limited to banks and large institutions. Through this offering, individuals can participate in existing business payment arrangements by taking over the right to receive a defined portion of payments from an active contract.

These contracts already operate on fixed schedules, with clear amounts and timelines. LendeeApp reviews and lists eligible portions on the platform, making them accessible in a transparent and straightforward way. There are no new agreements to negotiate and no business operations to manage — servicing and tracking are handled end-to-end.

By enabling access to real, ongoing business payment flows, Contract Receivables supports LendeeApp's broader mission: creating a more inclusive financial ecosystem where participation is not limited by scale or institutional access.